The Buzz on Home Insurance In Dallas Tx

Wiki Article

5 Easy Facts About Commercial Insurance In Dallas Tx Explained

Table of ContentsSome Known Details About Insurance Agency In Dallas Tx Life Insurance In Dallas Tx - QuestionsSome Known Questions About Truck Insurance In Dallas Tx.Health Insurance In Dallas Tx Things To Know Before You BuyThe Buzz on Commercial Insurance In Dallas TxThe Main Principles Of Health Insurance In Dallas Tx

The costs is the amount you pay (usually monthly) in exchange for health insurance policy. Cost-sharing refers to the portion of eligible health care costs the insurance firm pays as well as the portion you pay out-of-pocket.This kind of wellness insurance has a high insurance deductible that you have to meet prior to your wellness insurance policy protection takes effect. These plans can be right for people who want to save cash with reduced month-to-month premiums and do not intend to utilize their clinical protection extensively.

The downside to this sort of insurance coverage is that it does not meet the minimum necessary protection required by the Affordable Care Act, so you might likewise go through the tax fine. Additionally, short-term strategies can omit insurance coverage for pre-existing problems. Temporary insurance coverage is non-renewable, and doesn't consist of insurance coverage for preventative care such as physicals, vaccines, dental, or vision.

The Best Guide To Commercial Insurance In Dallas Tx

Consult your own tax, audit, or lawful expert instead of depending on this article as tax, audit, or legal recommendations.

You can commonly "leave out" any kind of household participant that does not drive your cars and truck, yet in order to do so, you must submit an "exemption type" to your insurance coverage company. Chauffeurs who only have a Student's License are not needed to be listed on your policy till they are totally certified.

Our Truck Insurance In Dallas Tx Statements

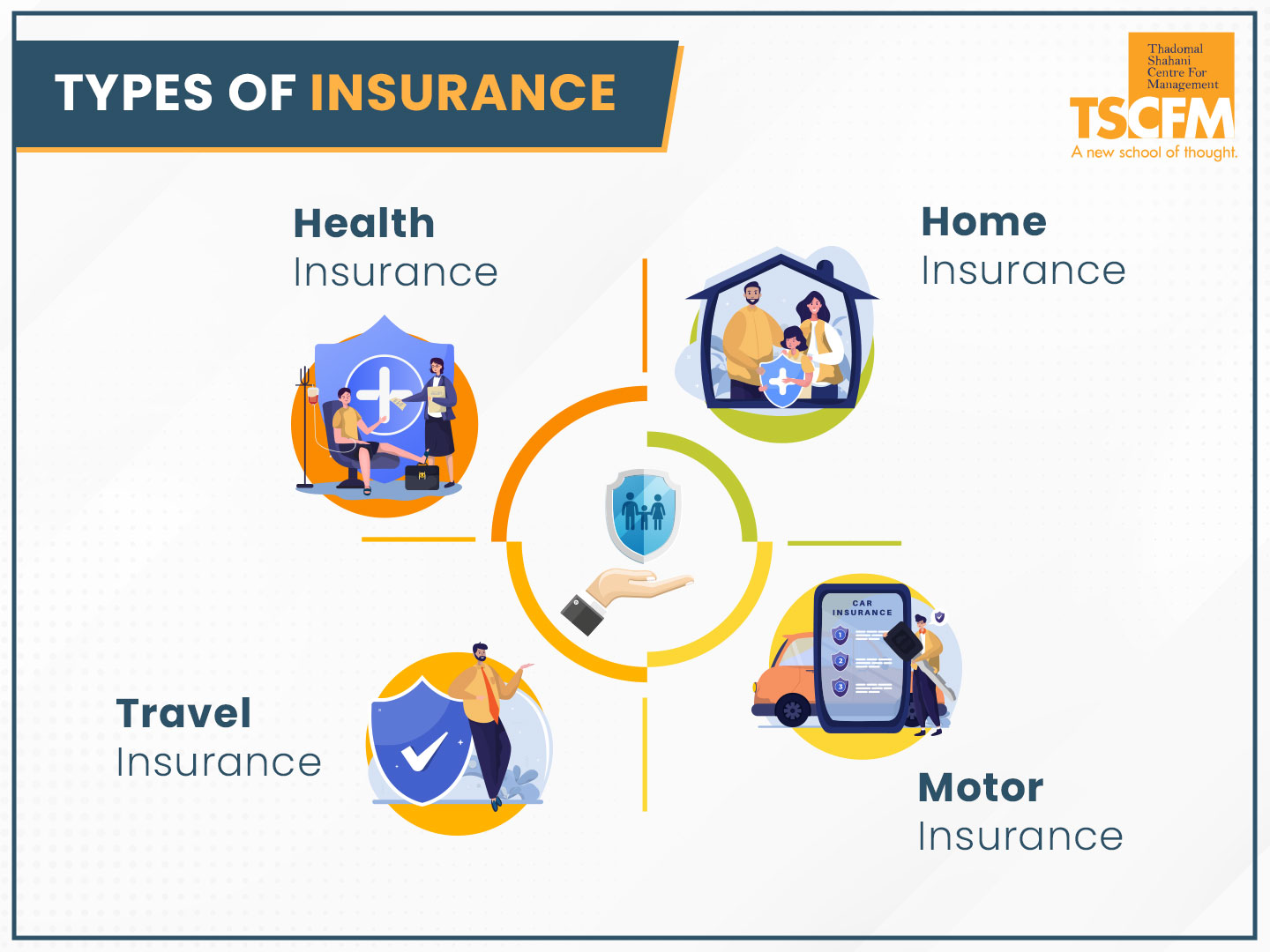

You need to acquire insurance coverage to safeguard on your own, your family, as well as your wide range (Home insurance in Dallas TX). An insurance policy can save you thousands of bucks in case of a crash, health problem, or calamity. As you strike certain life landmarks, some plans, including medical insurance and also automobile insurance coverage, are essentially needed, while others like life insurance policy and also special needs insurance are strongly motivated.Mishaps, health problem as well as catastrophes happen all the time. At worst, events like these can dive you into deep financial ruin if you do not have insurance to draw on. Some insurance coverage are inevitable (believe: car insurance in most this post US states), while others are just a wise monetary decision (think: life insurance).

And also, as your life adjustments (say, you get a new work or have a child) so needs to your insurance coverage. Listed below, we've discussed briefly which insurance coverage you ought to highly consider acquiring at every stage of life. Keep in mind that while the policies below are prepared by age, obviously they aren't ready in stone.

Not known Factual Statements About Insurance Agency In Dallas Tx

Below's a brief summary of the plans you require and also when you require them: Many Americans require insurance to afford healthcare. Choosing the strategy that's right for you may take some research study, yet it offers as your initial line of defense against clinical debt, one of most significant sources of financial obligation among customers in the United States.In 49 of the 50 US states, drivers are required to have vehicle insurance coverage to cover any kind of possible property damages and also physical harm that may arise from an accident. Automobile insurance coverage rates are mainly based upon age, credit rating, auto make and Go Here version, driving record and area. Some states also take into consideration sex.

9 Simple Techniques For Home Insurance In Dallas Tx

An insurance firm will certainly consider your residence's place, along with the dimension, age as well as develop of the house to determine your insurance policy premium. Homes in wildfire-, hurricane- or hurricane-prone locations will certainly nearly constantly regulate higher premiums. If you market your residence and also go back to renting, Go Here or make various other living setups (Insurance agency in Dallas TX).

For people who are aging or handicapped and need assistance with everyday living, whether in an assisted living facility or through hospice, long-term treatment insurance coverage can help shoulder the expensive costs. This is the type of point people do not consider until they grow older and realize this could be a truth for them, but of course, as you obtain older you get a lot more costly to guarantee.

For the a lot of component, there are 2 sorts of life insurance intends - either term or long-term plans or some combination of the 2. Life insurance firms offer numerous kinds of term plans as well as standard life plans in addition to "rate of interest sensitive" items which have actually become extra common given that the 1980's.

The Buzz on Health Insurance In Dallas Tx

Term insurance coverage supplies protection for a specified period of time. This period could be as brief as one year or provide coverage for a specific variety of years such as 5, 10, 20 years or to a defined age such as 80 or in some cases approximately the earliest age in the life insurance policy mortality.The longer the warranty, the greater the initial premium. If you die throughout the term period, the company will pay the face quantity of the policy to your beneficiary. If you live beyond the term duration you had selected, no benefit is payable. Generally, term policies use a fatality advantage without cost savings component or cash money value.

Report this wiki page